Slash and Burn

💸 Grover Norquist stays on message · Reappraisals · O'Connell unphased · Biden's Gone · Repeat tourist offender of day · Much more!

Good afternoon, everyone.

Hope everyone had a nice Easter Sunday.

Onward, Davis.

“Trade deficit is about as close to a meaningless term as you can come up with,” Grover Norquist told me over breakfast at a coffee shop downtown. “You have a trade deficit with a local grocery store, right?” I’d asked him about what’s on everyone’s mind: Trump using tariffs to rebalance the country’s global trade deficit.

The chief proprietor of Americans for Tax Reform and the man the Boston Globe once called the Most Powerful Man in America is still on his grind after all these years: slashing spending and cutting taxes. “Tariffs are a tax,” he told me when we got there. “They take money away from individuals.”

Founded in 1985 at Ronald Reagan’s behest, the organization’s flagship project is the Taxpayer Protection Pledge, a written promise by legislators that commits them to opposing any and all efforts to increase the tax burden on individuals and businesses.

That afternoon at a talk at the state capitol, Norquist distributed a chart of congressional control dating back to 1933. Before 1994, when ATR unveiled its tax pledge, Democrats all but owned Capitol Hill, ceding Congress to Republicans only 4 times in 62 years. Then came 1994: in the 32 years since, the GOP has held the reins for 18 of them.

Growing up in the ambience of Reagan Republicanism, I heard a lot about taxes and spending and government waste and corruption. So over the years, my attention toward such matters waned like a once-earnest Christian convert rotely taking Holy Communion. Spending time with Norquist was like seeing the light all over again.

Amid the arcane financial gymnastics that defined the Biden era and as meme stocks and crypto churned, millions began treating macro‑economics like a casino—proof, Norquist would say, of what happens when the government tilts the table with loose money and higher taxes.

The common man bought Bitcoin. The price went up. He got rich. Or maybe he bought Tesla or Gamestop or a cryptocurrency called Fartcoin. The retail investor had finally taken it to the man. The experts took one on the chin, and whatever malformed ideas Joe Schmo had about how the economy actually works would find more than enough allowance to further entrench them as graphs largely went up and to the right.

But, as the cold reality of our economic situation sets in amidst the Trump administration’s enforcement of protective tariffs, uncertainty and instability have shaken the faith of the blessed day traders and cryptocurrency commoners.

It is in such an environment, where the economy visibly resembles a tarot spread, that the Norquist’s message sounds through the haze with the clarity and force of a fog horn. Never mind the Federal Reserve and its money printer, Blackrock, tariffs, or whatever media-induced specter of economic corruption looms on the horizon and in the minds of the American people. Instead, back to the basics: taxes and spending.

Trump called tariff the ‘most beautiful word’ on the campaign trail in 2024, and while the MAGA faithful bit hook, line, and sinker, the more hesitant Trump supporters thought it was just a word without weight. When Trump uttered tariff, the word seemed to flutter off into the clouds of impossibility, which may explain the whiplash that has followed them.

When Norquist utters the word tax—and he utters it a lot—there’s no doubt in your mind that he’s serious. His diction brings to mind an axe. You can almost hear the paper shredding as he drives an axe head through reams of budget line items and overwrought tax code.

Currently, Trump World seems to wobble between abolishing the income tax, abolishing the capital gains tax, and/or raising taxes on the wealthy (an overt violation of the sacred pledge) by alchemically marrying them to import tariffs to make up the difference. Meanwhile, Norquist and ATR’s ideas continue to find purchase at the state level. Most recently, Mississippi passed legislation to phase out its income tax.

Norquist’s strength is his tunnel vision. Let crypto bubbles swell, the Fed pump out cheap cash, and Trump push tariffs—none of that touches your wallet the way a tax hike does. For 40 years, he’s swung the same axe: stop new taxes, starve runaway spending, and let the rest of Washington’s gimmicks implode on their own. Even as some Republicans daydream up fresh revenue schemes, his Taxpayer Protection Pledge stays wedged in the framework like a stubborn rivet, daring anyone to pry it loose and learn how fast the whole contraption could collapse. DAVIS HUNT

⧖⧗⧖ SHOW YOUR SUPPORT ⧗⧖⧗

If you want to support our work at The Pamphleteer, a recurring donation is the best way. We have a $10/month Grub Street tier and a $50/month Bard tier. Membership gets you access to our comments section and free access to upcoming events.

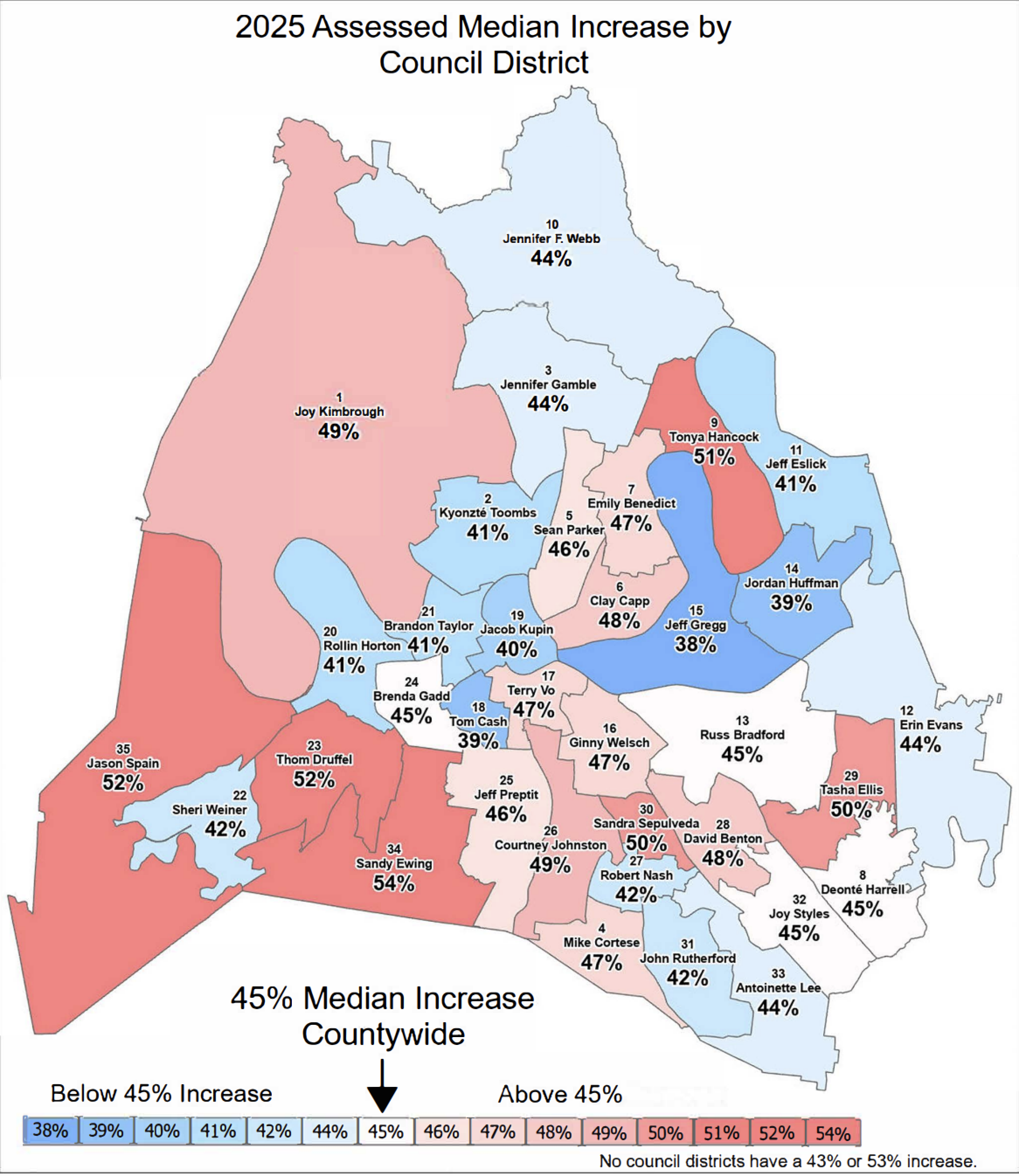

🏠 Rollin’ In The Home Value Property reappraisals are in, and here’s what council members are saying. “The results show a 45 percent median increase in value of the average property in Nashville over the past four years,” Councilmember Erin Evans shared in this morning’s District 12 Dispatch before comparing it to 2021’s average increase (34 percent) and 2017 (37 percent).

State law prevents local governments from raking in more tax revenue after a reappraisal, so tax rates will be adjusted accordingly. Evans explained that owners whose property value increased less than the median can expect their tax rate to decrease, while those whose value increased more than the median can generally expect their rate to go up. For perspective, 16 out of Davidson County’s 35 Districts exceeded this year’s median. “The reappraisal process is not the budget process,” the District 12 councilmember reminded her constituents. “The budget process kicks off with the Mayor's ‘State of Metro’ address on May 1st.”

Councilmember Ginny Welsch put a finer point on the process in her District 16 Newsletter earlier this month: “The CTR is not necessarily the final tax rate, unless the Mayor and council decide that the revenue brought in under the CTR can fully fund and cover the services that Metro needs to provide its citizens: schools, public health, parks, libraries and arts, police and fire, emergency services, etc. But a problem inherent to this taxation model is that if the CTR is not increased, Nashville does not capture the increased tax revenue from new properties and construction since the last reappraisal.”

That said, Councilmember Emily Benedict has already preemptively blamed the current presidential administration for Metro’s inevitable property tax increase this budget season. “The biggest gap that we're going to see this year is in the federal cuts being made to Health, Education, and Housing,” she wrote in reply to a constituent inquiring about property tax increases.

“If the Federal Government won't send our income taxes back to the states (and I haven't heard of any tax cuts yet), and if we want to continue our city services, then we will have to pay for them somehow. I anticipate that the changes by the current administration in Washington, D.C. will have a significant negative impact on our ability to pay for things locally. So if we want police, fire, roads, education, affordable housing, parks, trash, and more, then we have to fund them locally. And as tourism declines, reportedly due to immigration policies, we can't rely on our sales tax revenue (2.75%) to grow like it has in the past.”

Nashvillians will likely get their reappraisal notices in the mail over the next few days, and there is an appeal process.

🚍 O’Connell Unphased By CHYM Ruling Despite including the acquisition of land near transit centers for affordable housing in his Choose How You Move transportation improvement plan, Mayor O’Connell doesn’t think that particular proposal mattered to Nashvillians back in November. “I don't think it really was an important factor for voters' consideration,” he said during last week’s media roundtable when asked about the Tennessee Court of Appeals decision to strip the ability to purchase property for housing development and parks out of his program.

You may recall that three major social justice groups—Stand Up Nashville (SUN), the Tennessee Immigrant and Refugee Rights Coalition (TIRRC), and The Equity Alliance (TEA)—backed the mayor’s proposal by forming a coalition called Shift Nashville in the fall. Their support hinged upon five crucial policy points, and affordable housing was one of them. Other groups, like the Alliance for an Affordable Nashville, also vocalized support with similar expectations. But on Friday, the mayor said that he thinks “voters were responding principally to those four core pillars of the program, which were really the mobility-focused areas, the sidewalks, signal service, and safety is what I think really was happening.”

Given the recent ruling, Emily Evans—chair of the Committee to Stop an Unfair Tax that challenged the validity of Mayor O’Connell’s transit plan in court—now questions whether the campaign was misleading to voters and has hinted that the matter may end up in the Tennessee Supreme Court. For now, O’Connell’s optimistic that the council’s response to the recent Housing and Infrastructure Study, the “Unified Housing Strategy that we're hoping gets finalized in time for the budget,” private sector interest in redeveloping areas near transit stations, and a “mix of state and federal and local funding” will make up for what’s been stripped from his plan: “That portion of the ruling does not deeply concern us.”

🏛️ It’s Okay Guys, Biden’s Gone Last week, Representative Caleb Hemmer (D-Nashville) pushed back against the expansion of Tennessee’s Attorney General’s office and its unit designed to defend against federal overreach. On Wednesday, Hemmer proposed an amendment to this year’s budget that would redirect $4.5 million from the AG’s special litigation program into the Governor’s proposed Starter Home Revolving Loan Fund. “Originally, a special litigation unit was established to fight policies in the Biden administration,” he said during the House Floor Session. “Well, you don't have to worry about that anymore. But yet, still, you know, they're out there fighting, wanting more and more of this.”

Hemmer was also critical of the AG’s request for “40 new staff positions” and mentioned that the office’s case load has decreased. It’s worth noting that a bill has already passed through the House that would place Tennessee’s Human Rights Commission under the control of the Attorney General’s Office. If adopted, it would move the staff and caseload over to a newly formed Division of Civil Rights Enforcement.

PROPERTY VALUES INCREASE

DEVELOPMENT

- Developers start work on luxury development, 2121 Crestmoor, near Green Hills mall (NBJ)

- American Pickers star to close Nashville store after 14 years (NBJ)

- Chattanooga’s Champy’s, fried chicken concept, set for Nashville location (Post)

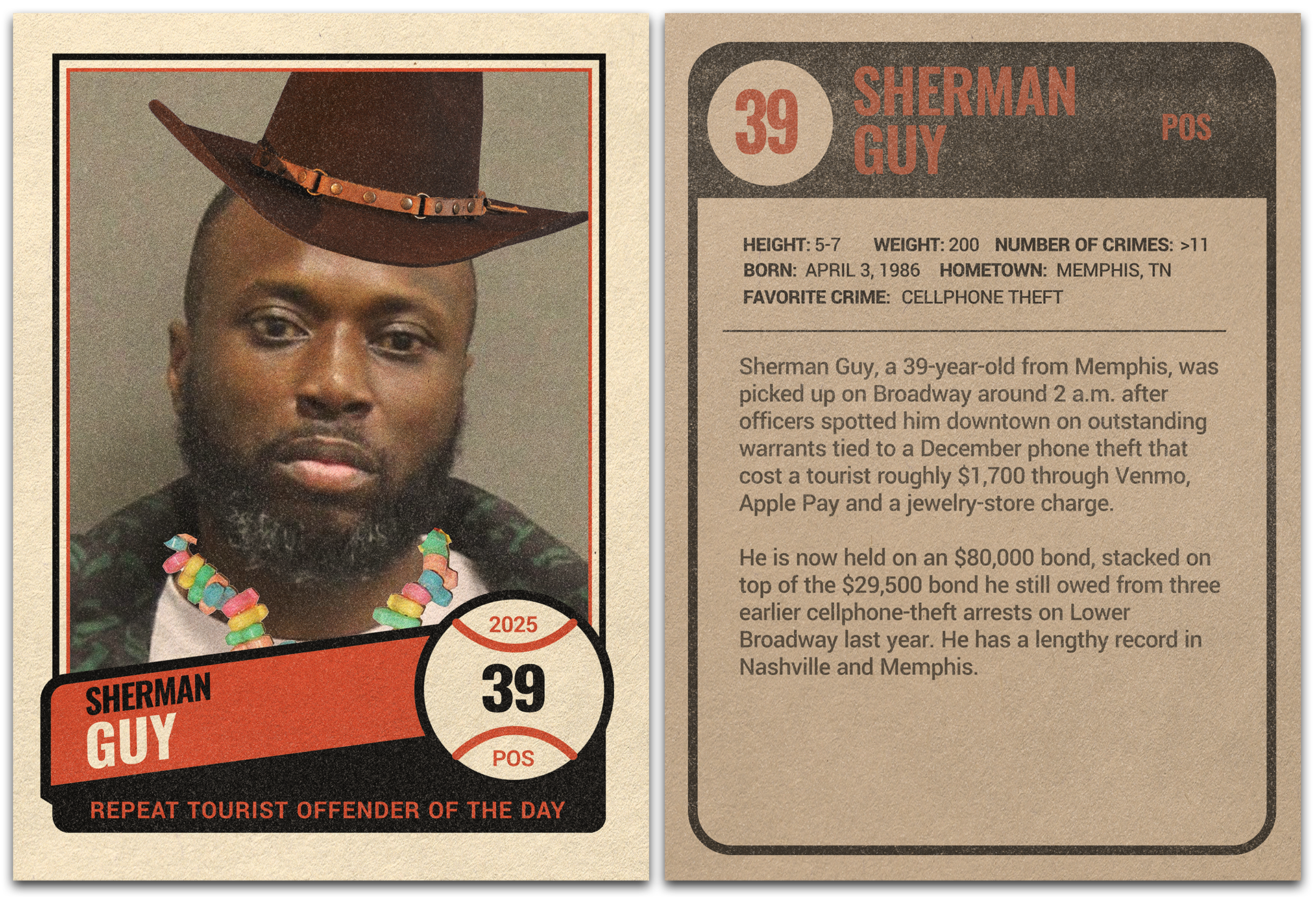

✹ REPEAT TOURIST OFFENDER OF THE DAY

Sherman Guy, 39, a Memphis road‑warrior who treats Lower Broadway like a self‑checkout lane. Metro officers nabbed him again after a 2 a.m. stroll turned into yet another cellphone snatch‑and‑cash caper: police say he lifted a tourist’s iPhone, hopped on Venmo and Apple Pay, and funneled nearly $1,700 straight to a Memphis jewelry store before anyone could hit “Find My iPhone.”

Sound familiar? It should. Guy is already sitting on seven pending Nashville felonies—all variations on grand‑mobile‑larceny and identity theft—from late‑2024 heists downtown. And long before he discovered Broadway’s easy marks, he notched a felony conviction for pushing counterfeit drugs (plus a pair of trespass cases for seasoning).

Current tally: one suspended sentence, seven open charges, and now an extra $80,000 bond for the latest grab‑and‑go, making him our Repeat Tourist Offender of the Day!

THINGS TO DO

View our calendar for the week here and our weekly film rundown here.

📅 Visit our On The Radar list to find upcoming events around Nashville.

🎧 On Spotify: Pamphleteer's Picks, a playlist of our favorite bands in town this week.

👨🏻🌾 Check out our Nashville farmer's market guide.

TONIGHT

🪕 Kyle Tuttle Band @ Dee's Lounge, 6p, $10, Info

🪕 A Good Mix: Celebrating the Life & Legend of Kurt Storey @ Station Inn, 8p, Free, Info

🪕 Analog Bluegrass presents Jason Carter Band @ Analog at Hutton Hotel, 8p, $15, Info

🎸 Timbo & Lonesome Country @ Jane's Hideaway, 8p, Info

+ modern take on classic country, bluegrass & hillbilly Jazz

🪕 Val Storey, Carl Jackson, Larry Cordle & New Monday @ Station Inn, 8p, $20, Info

💀 Grateful Monday @ Acme Feed & Seed, 7p, Free, Info

🕺 Motown Monday @ The 5 Spot, 9p, $5, Info

📰 Check out the full newsletter archive here.

Today's newsletter is brought to you by Megan Podsiedlik (Nashville), Jerod Hollyfield (Crowd Corner), Camelia Brennan (Local Noise), and Davis Hunt (everything else).